Holiday allowance and vacation days in the Netherlands TOSS in Holland

This only applies when you pay your employee at least 108% of the statutory minimum wage. Do you pay minimum wage? This means your employee still has the legal right to 8% holiday allowance. Does your employee earn over 3 times the legal minimum wage? You do not have to pay holiday allowance, or you can pay less holiday allowance.

What is the Dutch holiday allowance — and how do you get the cash? DutchReview

Holiday allowance was introduced in the Netherlands in the 1920s in order to stimulate workers to go on vacation and was conceived as a sort of paid leave. But back then, travelling abroad used to be very expensive and in the 1960s, holiday allowance became an extra payment on top of your salary and was paid in May.

What is Holiday Allowance (Vakantiegeld) in the Netherlands? Blue Lynx

Holiday allowance in the Netherlands. Posted on 23/04/2022 13/05/2022 Updated on 13/05/2022 Payroll - HR.. When the holiday allowance is paid, taxes are immediately withheld by the employer and the right tax credits are calculated. And for those who benefit from the 30% ruling, this also applies to the holiday allowance..

8 Holiday Allowance in the Netherlands YouTube

By law, the minimum number of Dutch holidays to which employees are entitled each year is four times the number of working days a week. In the case of a full-time employment (pro-rated working part time), the employee is entitled to a minimum of 20 holidays per year (4 x 5 working days a week). The holiday year runs from 1 January to 31 December.

Holiday allowance around the world infographic Visualistan

Your sector's CAO may state that a Christian public holiday can be substituted for an alternative religious holiday, such as Eid Al-Fitr at the end of Ramadan, or Chanukah. The public holidays in the Netherlands are: New Year's Day (1 January) Good Friday. Easter Sunday. Easter Monday. King's Day (27 April) Liberation Day (5 May, see also below)

Tax Holiday vs Tax Allowance Taxvisory

For income up to €73,031, the rate is 36.93%. For income above that amount, the top rate is 49.50%. Holiday pay is a form of income paid in addition to the regular salary. Therefore, it is subject to the highest applicable tax rate for the employee. So, if an employee has a taxable income of €75,000, their holiday pay falls into the high.

2021 The Netherlands List of Holidays in PDF, Word, and Excel

The amount of holiday allowance you get is 8% of your gross annual salary. Suppose your gross annual salary is EUR 36,500.00 then you do the following: EUR 36,500.00 x 8% = EUR 2,920.00. Your (gross) holiday allowance is then EUR 2,920.00. This amount is paid to you on top of your normal salary.

holiday allowance / extra vacation payment / extra vacation paymsent / holiday pay Stock Photo

Dutch Holiday allowance is a mandatory payment by employers of an extra wage to their employees. As of January 2020, the standard rate is a minimum of 8% of your total wage or 8.33% for temporary workers. READ MORE: Wages in the Netherlands: the 2020 guide to Dutch salaries. A Collective Bargaining Agreement (CAO) is operated by most work.

Holiday allowance and vacation days in the Netherlands

Holiday pay is identified by law as an 8 percent remuneration paid in either the month of May or June. If a company decides to pay the vacation allowance in a month other than May or June, this allowance cannot be regarded to be your vacation allowance. The employees will still have a right to vacation allowance, next to this other allowance.

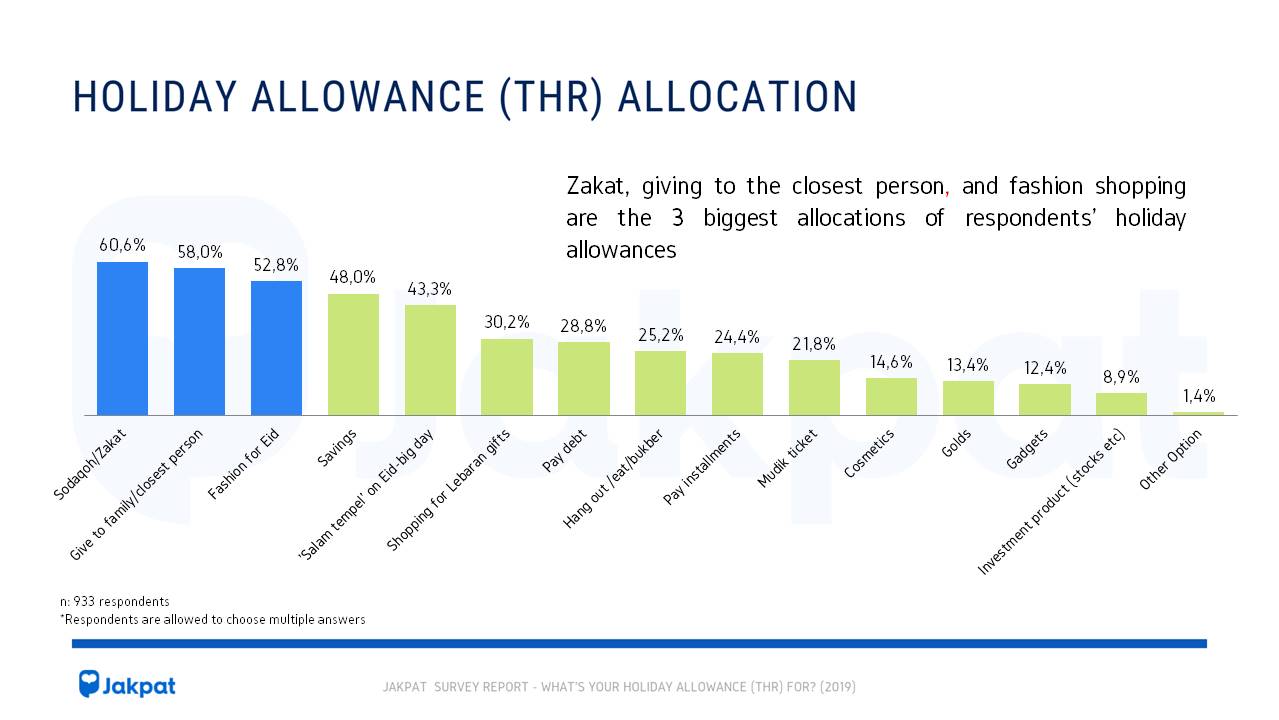

What's Your Holiday Allowance (THR) for? JAKPAT Special Report Jakpat

Holiday pay is identified by law as an 8 percent remuneration paid in either the month of May or June. If a company decides to pay the vacation allowance in a month other than May or June, this allowance cannot be regarded to be your vacation allowance. The employees will still have a right to vacation allowance, next to this other allowance.

Holiday allowance stock photo. Image of canvas, destination 5150576

Holiday allowance in the Netherlands. Holiday allowance in the Netherlands ("vakentiegel") is a gross payment of 8% of your total gross salary. Although employers are obliged to pay this 8% holiday allowance to their staff, it is up to them whether to pay it all at once in may or spread it over 12 months instead.

Netherlands Public Holidays In 2021 iFlow Public Holidays By Country

What is Holiday Allowance? Holiday allowance is a mandatory financial benefit in the Netherlands. Introduced to encourage workers to take vacations, it constitutes an additional payment on top of the employee's salary. This allowance typically amounts to 8% of the employee's gross annual salary.

Bank Holidays In Netherlands 2023 ODINT Consulting

Holiday allowance - "Vakantiegeld" in Dutch - is a mandatory payment by employers in the Netherlands, an additional amount of money on top of the employee's gross salary. As of January 2020, the standard rate is a minimum of 8% of an employee's last year gross salary. Only if an employee earns over three times the legal minimum wage, the.

Netherlands Public Holidays 2024

In 1966, the Holiday Act was introduced, giving all workers over 18 in the Netherlands the right to paid time off for vacations. How to calculate holiday allowance for an employee.. Typically, holiday allowance is paid out once per year as a lump sum during the month of May. Because the idea behind the allowance was to provide employees with.

How to apply & get house rent allowance in Netherlands 🇳🇱 as expats? YouTube

Once a year, most working people in the Netherlands receive nearly double their monthly salary. The Dutch Holiday allowance (in Dutch: "vakantiegeld") is worth 8% of the gross annual salary and is normally paid out every May. Right in time to finance your Summer holiday! The holiday allowance is an additional sum paid on top of your gross.

Vacation allowance or holiday pay

The holiday allowance was conceived as an incentive to stimulate workers to take vacations and was introduced in the Netherlands in the 1920s. Back then, traveling abroad was very expensive, and in the 1960s, the holiday allowance became an extra payment on top of your salary and was to be paid in May.

- Repudiatory Breach Of Contract Meaning

- Lance Armstrong Tour De France

- La Puerta De Palacio Sevilla

- Gzsz Verpasst Heute Kostenlos Anschauen

- Grondslag Voordeel Uit Sparen En Beleggen Verdelen

- How Long Do Bunny Rabbits Live

- In Welk Stadion Wordt De Champions League Finale Gespeeld

- De Langste Dag Van Het Jaar

- Wie Is De Mol Deelnemers 2022

- Chelsea F C Vs Fulham F C Timeline