What is Sort Code?

What is a branch sort code - and what is a bank sort code? Sometimes people use this term to emphasize that the sort code is especially referring to a certain branch of a bank. Others simply call it a bank sort code. This is all a little misleading, as every sort code contains the necessary information to both link payments to your bank and.

How do I find my bank sort code Boi? YouTube

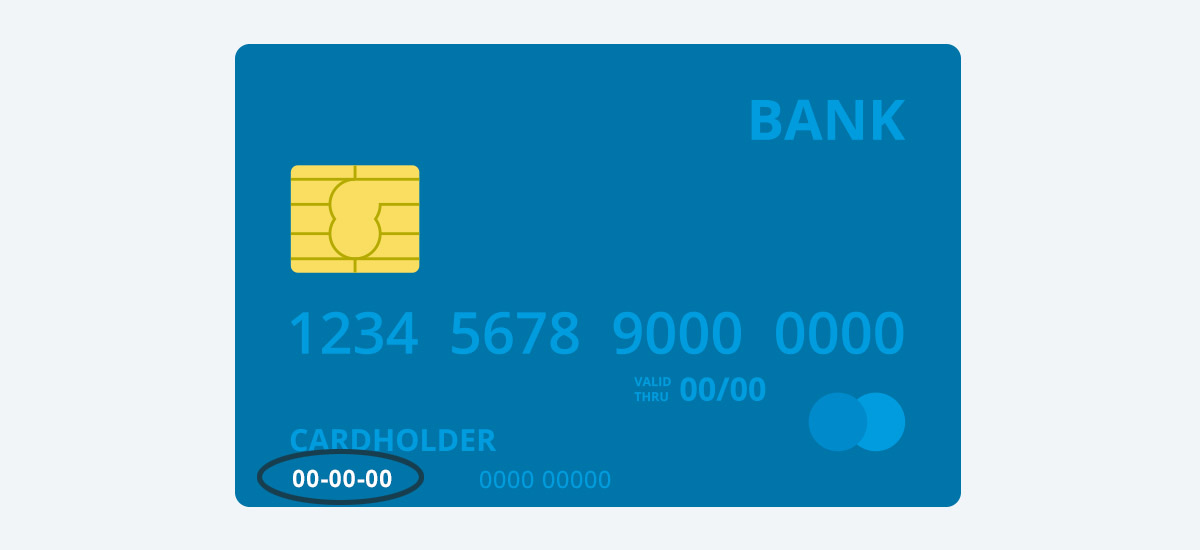

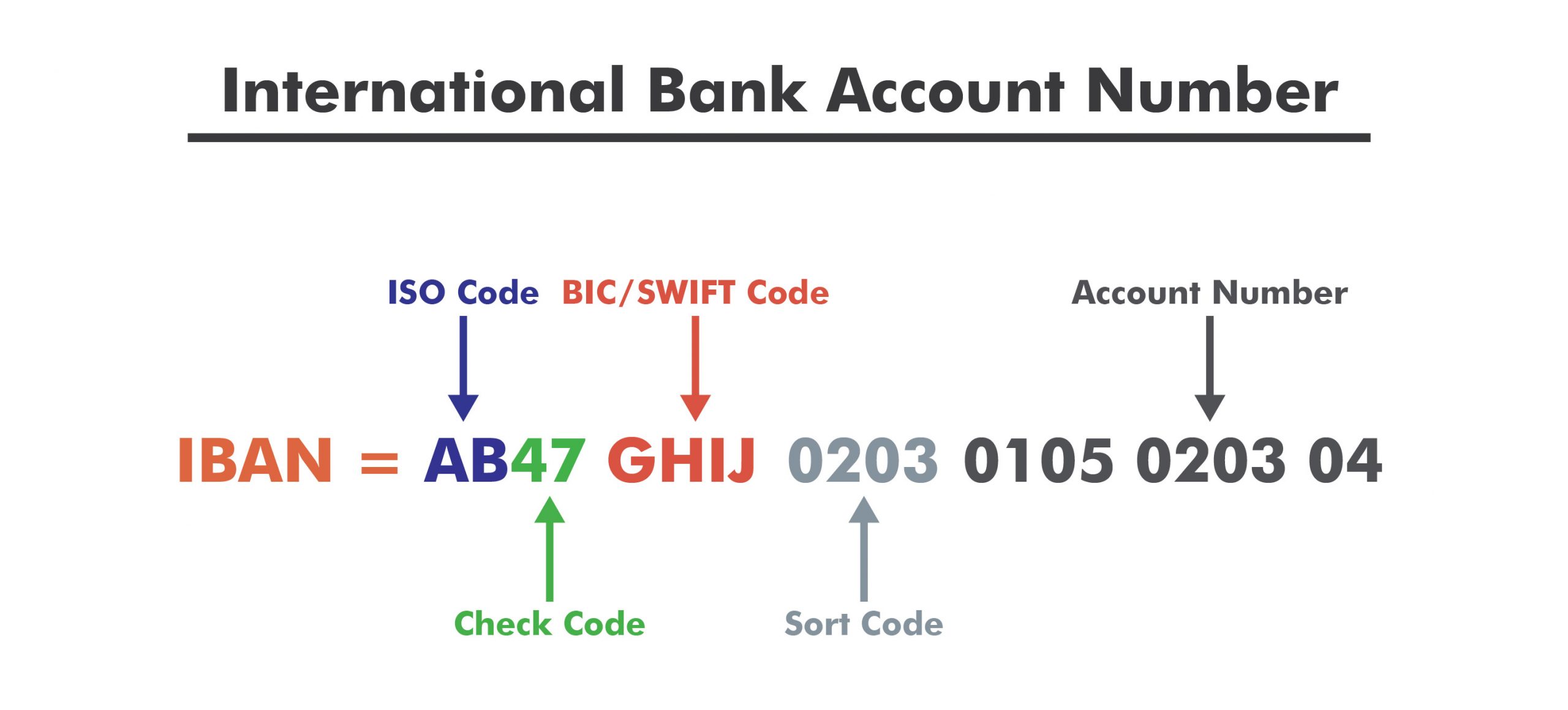

A SWIFT code is an alternate format of a BIC (Bank Identification Code) and the terms are interchangeably used. Format Sort codes. Sort codes are made of 6 numbers, divided into 3 pairs, for example: 12-34-56. SWIFT codes. SWIFT codes are a bit more complicated as they can range from 8 to 11 alphanumeric characters.

Bank Identifier Code Niki Mossel

A sort code is a 6-digit numerical identifier assigned to each branch of a financial institution in the United Kingdom. Sort codes are issued to banks, building societies, credit unions, and other financial institutions where accounts are held. Importantly, a sort code identifies the specific branch of a specific financial institution.

What Is a Sort Code? What It Looks Like & How To Find It Statrys

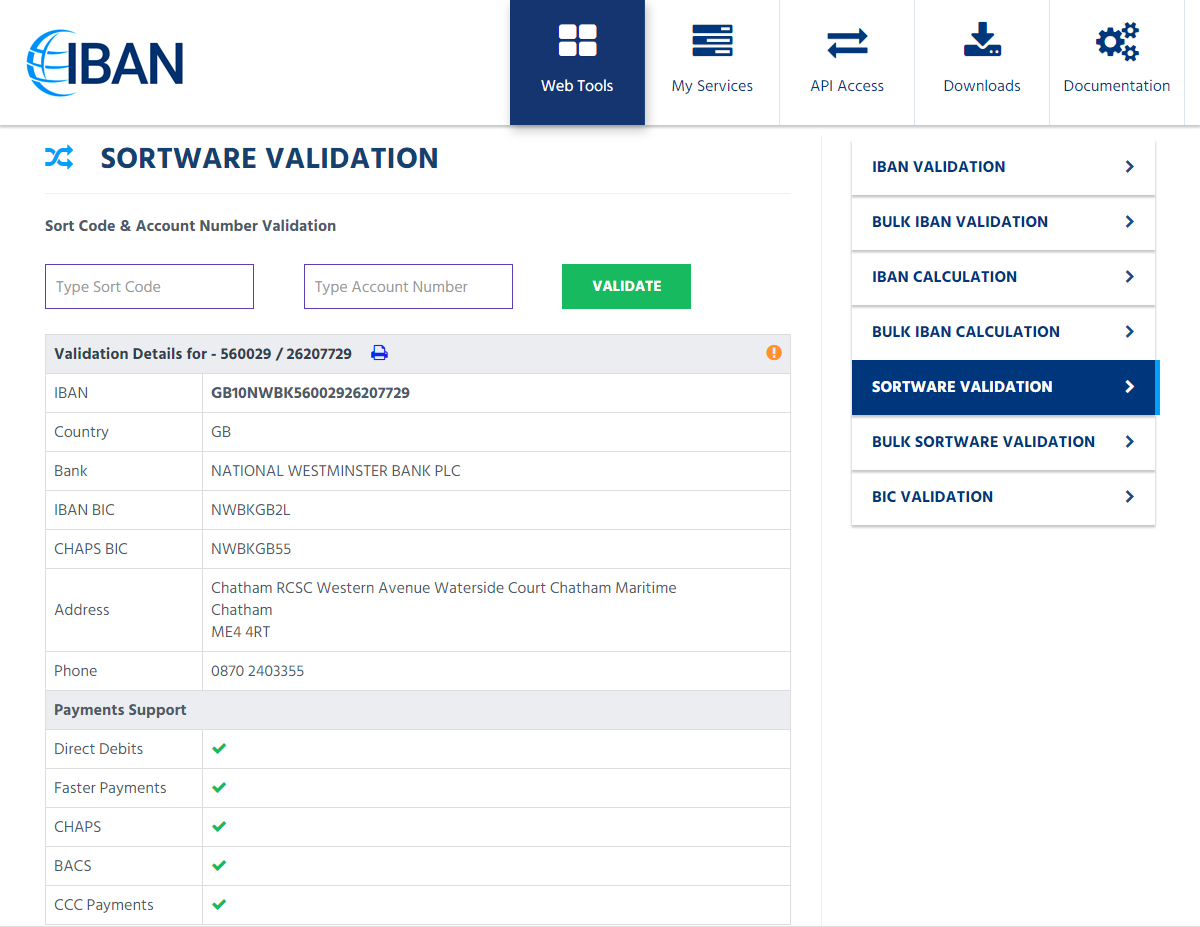

If found in the bank directory, the sort code checker returns the bank name, branch, address and payment and other clearing system information. We also will check the SWIFT code associated with the sort code which is used in the IBAN for international bank payments. To use the service without limitations, please feel free to purchase a license.

What is Bank Sort Code? YouTube

The account number of the person or company you want to pay, plus the sort code that identifies where the account is held. Arguably, the sort code is more important than the account number. That may seem odd, but let me explain. If the sort code is incorrect, your money may end up in the wrong bank branch, or even with a different bank.

Cuál es el Sort Code del BBVA Wise

A sort code in banking is used to identify a particular UK bank and branch. Sort codes are particularly important when sending payments to UK bank accounts, as they help make sure the recipient's money ends up in the right place without unnecessary delays. You'll be asked to provide the sort code of the local UK account you're sending a.

Complete Guide to IBAN Numbers • International Bank Account Numbers

A sort code is a string of numbers that identifies two things: Your bank (for example, Barclays, Santander, or Lloyds) The specific bank branch where you opened your account. Every sort code consists of six digits arranged in three pairs. For example, your six-digit code might be 22-45-19. The first two digits identify your bank, while the.

What bank is sort code 07 04 36? YouTube

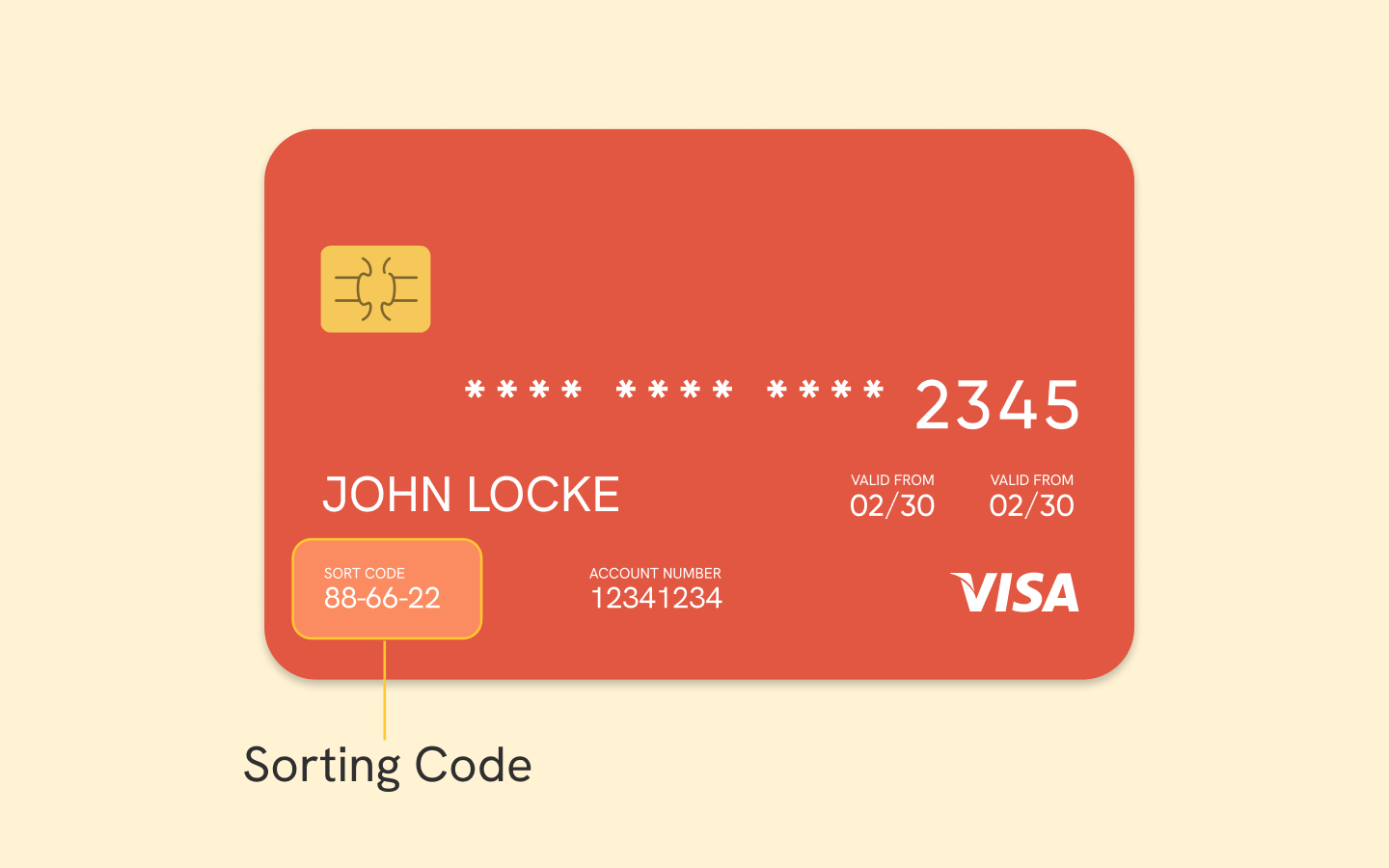

To find your bank sort code, you can check your bank card (the code is usually printed next to your account number) or use online banking. You can also try an online sort code finder with your bank branch details. It will help you map the code to the specific bank and may also give you a complete bank sort code list. Additionally, you can look.

Sort Code Checker Find, Identify Uk Banks Sort Code Mybankdetail

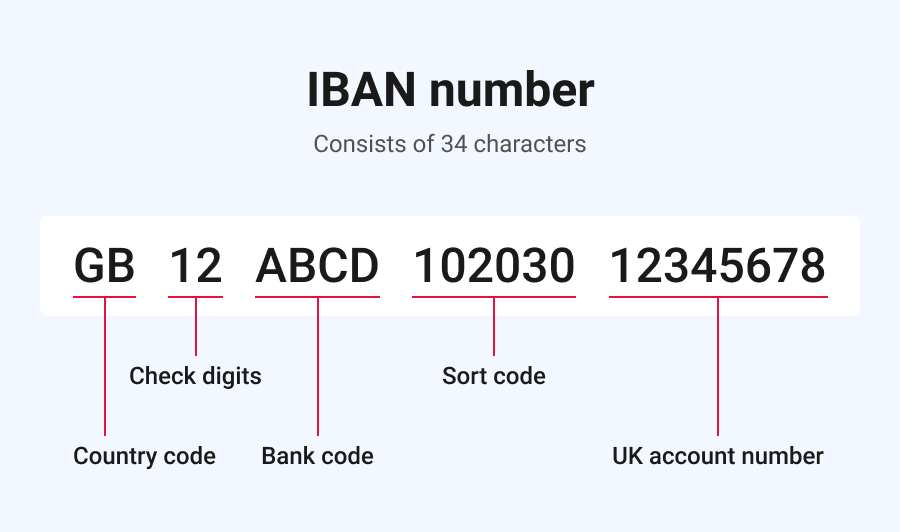

Online banking account or mobile app - This should be located under your account name or type, next to the account number. Alternatively, you can work out your sort code from the string of letters and numbers given to you in your IBAN number. Your sort code will be represented by the ninth to fourteenth numbers listed on your IBAN number.

What Is A Sort Code And Do UAE Banks Have Them?

What Is a Sort Code in Banking? In the world of banking, a sort code is a unique numerical code that is assigned to each branch of a bank. It serves as a way to identify and route funds accurately and efficiently within the banking system.

How To Find Sort Code And Account Numbers Effectively?

A Sort Code is a 6-digit number used to identify banks and financial institutions in the UK. The Sort Code, thus, serves as a routing number in the UK banking ecosystem by enabling banks to transfer money between accounts and ensure the funds reach the correct destination.

What are Bank Accounts Numbers & Sort Codes Nebeus Blog

The sort code is usually formatted as three pairs of numbers, for example 12-34-56. It identifies both the bank (in the first digit or the first two digits) and the branch where the account is held. [1] Sort codes are encoded into International Bank Account Numbers (IBANs) but are not encoded into Business Identifier Codes (BICs).

SortWare Sort Code Checker & UK Bank Account Validation API

A sort code is an important factor of your bank account. A sort code is a 6 digit number that identifies your bank. It's usually split up into pairs; the first two digits identify which bank it is and the last four digits refer to the specific branch of the bank, where you opened the account. Starling is branchless and all of our customers.

What Is SORT Code? Bank Sort Codes Explained Salt

A bank sort code is a type of routing number used in the United Kingdom and in Ireland. It's composed of six digits divided into three pairs. It routes money transfers by identifying the banks involved, as well as the location of the specific branches where the accounts are held.

Keystone Bank Sort Code for all Branches in Nigeria 2021 NaijNaira

Quite simply, a bank code is the numerical code assigned to a specific bank in order to identify it during financial transactions such as bank transfers. The codes are national, and are generally assigned by a country's central bank, or banking body. What do bank codes look like in the UK? UK banks use a 6 digit sort-code to identify the.

Sort Codes & Account Numbers Explained Suits Me® Blog

Your sort code is a unique numerical code that identifies your bank branch in the United Kingdom. It is essential for many banking transactions, including: Making payments to other UK bank accounts. Setting up direct debits and standing orders. Receiving payments from other UK bank accounts. Making international wire transfers.

- Samsung Galaxy Xcover 5 Enterprise Edition

- Armste Wijk Van Nederland 2023

- Mariah Carey And Christina Aguilera

- Naco A Company Of Royal Haskoningdhv

- Most Popular Black Eyed Peas Songs

- Mumford And Sons Tour 2023 Europe

- Hoe Heette De Beste Vriend Van Harry Potter

- 2 Euro Munten Die Veel Waard Zijn

- Room Mate Oscar Madrid Spain

- Reasonable Doubt Season 2 Release Date