Loan to Value what is it and why is it important?

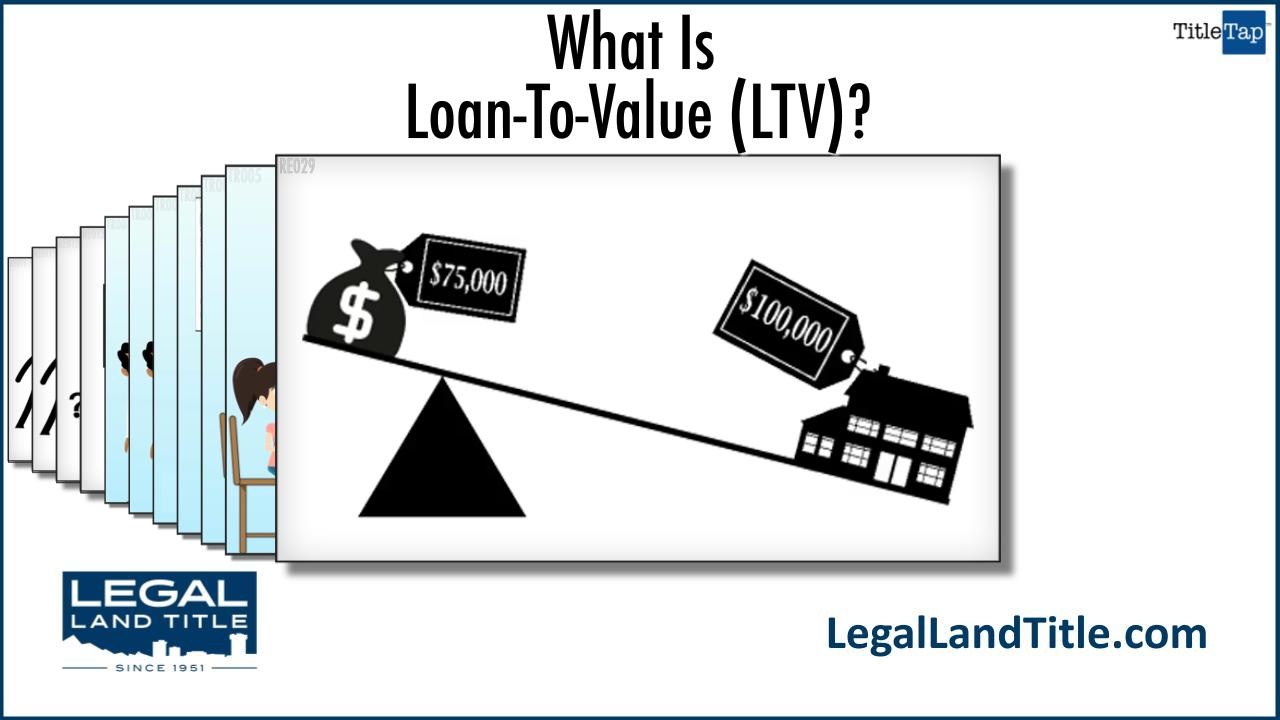

What Is Loan-to-Value (LTV) Ratio? The loan-to-value ratio is a simple formula that measures the amount of financing used to buy an asset relative to the value of that asset.

Wat betekent ‘loantovalue ratio’?

What is Loan to Value Ratio? The Loan to Value Ratio (LTV) is a credit risk metric that compares the size of a mortgage loan to the appraised value of a property as of the present date. Simply put, the formula to calculate the loan-to-value ratio (LTV) is the loan amount divided by the current appraised property value, expressed as a percentage.

What is loantovalue (LTV) and why does it matter?

The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased.. In real estate, the term is commonly used by banks and building societies to represent the ratio of the first mortgage line as a percentage of the total appraised value of real property.For instance, if someone borrows $130,000 to purchase a house worth $150,000.

LoanToValue (LTV) Ratio Meaning, Importance, Formula, & Interpretation

In other words, that lack of home equity translates to less skin in the game. For instance: Let's say you make a down payment of only 10%, or $25,000, on that home worth $250,000. That would.

What Is Loan To Value (LTV) And How Does It Affect The Size Of My Loan? Springfield, Ozark

The loan-to-value ratio is calculated by dividing the loan or mortgage amount by the property's appraised value. The resulting amount is then multiplied by 100. For example, if a borrower took out a $200,000 loan for a home valued at $250,000, their LTV ratio would be calculated as follows: LTV Ratio = 200,000/250,000 x 100.

Calcule sua Relação Loantovalue (LTV) para Evitar Liquidação Blog Binance

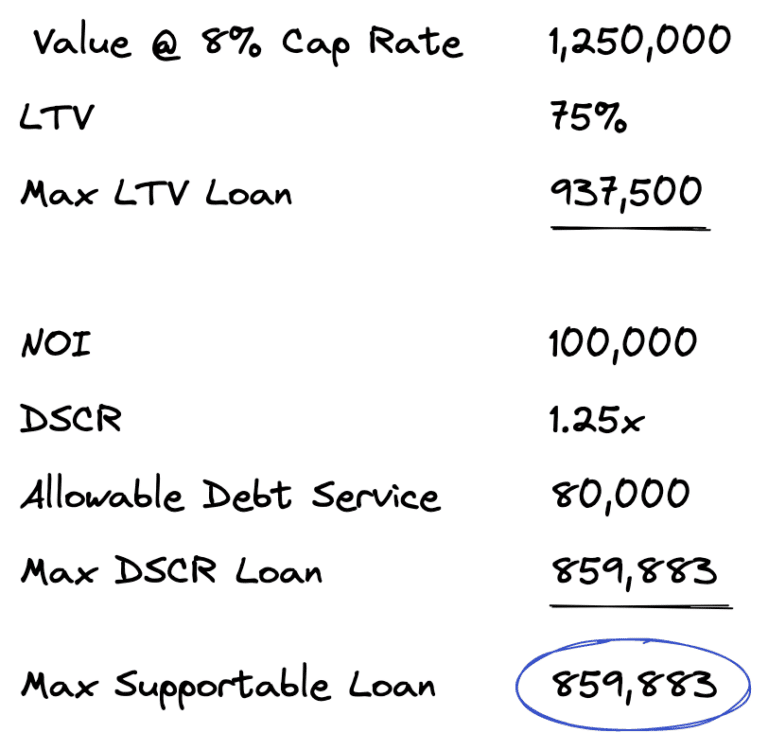

LTV represents the proportion of an asset that is being debt-financed. It's calculated as (Loan Amount / Asset Value) * 100. LTVs tend to be higher for assets that are considered more "desirable" as collateral security; however, LTVs are influenced by competitive forces in the market. There are a variety of ways to arrive at the "V.

What Is a LoantoValue (LTV) Ratio?

Loan-To-Value Calculator. Whether you're wondering if you have enough equity to qualify for the best mortgage rates, or you're concerned that you're too far upside-down to refinance under the Home.

Loantovalue ratio (LTV) What is LTV? Estradinglife

For example, say you're looking to buy a $350,000 home, and you've got $28,000 for a down payment. Subtract the down payment amount from the cost of the home to get the loan amount: $350,000.

Loan to Value Ratio (LTV) What is it and Why it Matters

Divide that total amount of $270,000 by the property value of $350,000, and your combined loan-to-value (CLTV) ratio is 77%. Appraised home value: $350,000. Total amount Owed: $270,000. LTV formula: $270,000/$350,000 = 0.77 or 77% LTV. An LTV of 57% is great, and while a CLTV of 77% is still good, it may have different risk implications for.

Loan to Value Ratio Example Explanation with Excel Template

Your "loan to value ratio" (LTV) compares the size of your mortgage loan to the value of the home. For example: If your home is worth $200,000, and you have a mortgage for $180,000, your LTV.

What is a Loan to Value Ratio or LTV (and Why Does it Matter)? Stessa

Loan-to-value ratio compares the size of a loan used to finance an asset with the value of that asset. It's commonly considered when you take out a mortgage to purchase a home. If you get a.

Understanding LoantoValue Ratio MCOCI

The loan-to-value ratio (LTV) is a percentage that measures the loan amount you need to borrow against the appraised value of the home you want to buy. For a refinance, your LTV is the sum of the outstanding balances for all liens against the appraised value of the property. Lenders frequently use the LTV ratio to assess any risks of lending money.

LoantoValue (LTV) Ratio A Guide to Understanding ELIKA New York

LTV ratio is a metric lenders use to compare a loan amount to the value of the asset purchased with the loan. For example, if a lender provides a loan worth half the value of the asset while the buyer covers the rest in cash, the LTV is 50%. LTV also reveals how much equity you have in your home by showing how much money would be left over.

LoanToValue Ratio (LTV) (All You Need To Know About LTV) Loanfasttrack

A loan-to-value (LTV) ratio compares the amount of a loan you're hoping to borrow against the appraised value of the property you want to buy. A higher LTV ratio suggests more risk because there's a higher chance of default.

:max_bytes(150000):strip_icc()/terms_l_loantovalue_FINAL-6da3330de08b41f59e7720fbfe227e07.jpg)

LoantoValue (LTV) Ratio What It Is, How To Calculate, Example

Loan-To-Value Ratio - LTV Ratio: The loan-to-value ratio (LTV ratio) is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage.

Loan to Value Ratio (LTV) A Calculation Guide PropertyMetrics

A Longer Definition: Loan-to-Value. Loan-to-value, often abbreviated as LTV, is a ratio that describes how much is owed on a home compared to what the home is worth. Along with credit scores and debt-to-income, loan-to-value is one of the three major components of a strong mortgage approval. Loan-to-value is the opposite of how much equity a.