8 Buy Now Pay Later Bnpl Solutions To Grow Your Business geekflare

Our editors are rounding up everything that's hot right now, all in one place. Download the App. Afterpay is fully integrated with all your favorite stores. Shop as usual, then choose Afterpay as your payment method at checkout. First-time customers complete a quick registration, returning customers simply log in.

Buy now pay later apps mountaintews

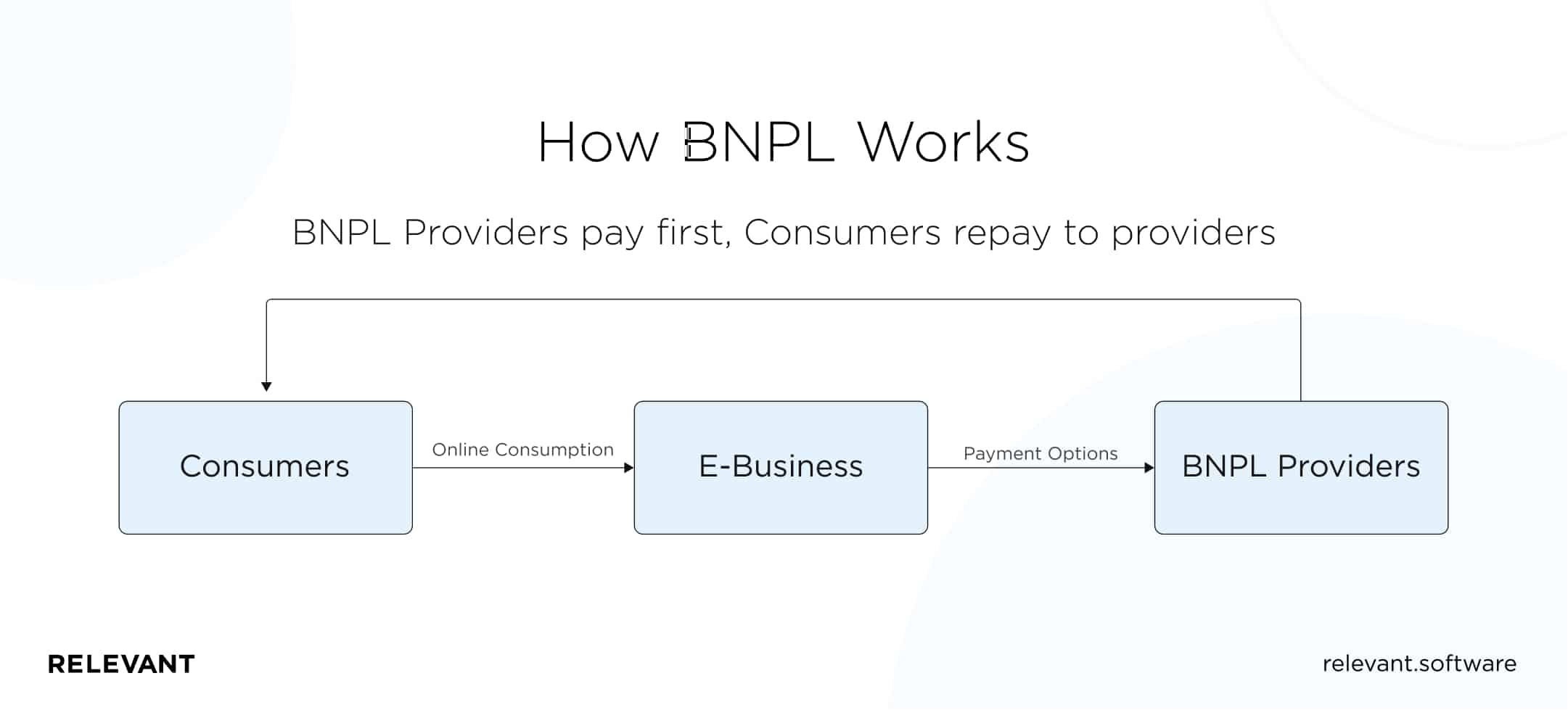

Buy now, pay later is a type of short-term financing. Consumers can make purchases and pay for them over time after an up-front payment. Buy now, pay later plans typically charge no interest.

How To Build Buy Now Pay Later App Simpl App

7. Zip (Quadpay): Best Buy Now Pay Later for Starters. Zip (formerly known as Quadpay) is a good option for those looking to skip the credit check. Zip offers 0% interest and doesn't report purchases or payment history to the credit bureaus. The trade-off is that Zip charges buyers a small fee for each transaction.

Buy Now Pay Later Banner Template. Buy Now Pay Later Ribbon Label Stock Vector Illustration of

Depending on your financial needs and preferences, there are different ways to break up your payments using buy now, pay later. With the Pay in 4 3 method from PayPal, for example, you can spread out purchases over four payments. So if you're buying a $400 product, you'll pay $100 at checkout and then $100 every two weeks for the next six weeks.

buy now pay later Neu Kitchens Neu Kitchens

Buy now, pay later, or BNPL, is a type of installment loan. It divides your purchase into multiple equal payments, with the first due at checkout. The remaining payments are billed to your debit.

Buy Now, Pay Later eBook by Jonathan Shapiro EPUB Book Rakuten Kobo United States

Interest charged: 0-36% APR. Repayment terms: 3-12 months. Borrowing amounts: $17,500. Founded in 2012, Affirm is one of the original buy now, pay later apps. Affirm allows you to finance.

6 Best Buy Now, Pay Later Apps of 2023 for Every Type of Shopper

"Buy now, pay later" is the ability to pay installments on a purchase you're about to make, usually online. Typically, an outside company is the one extending the offer.

Buy it Now, Pay Later Birth Partner

Financially Empowering the Next Generation. Financial freedom is a right, not a privilege. We're here to help you achieve financial freedom and take control over your finances so you can build your future. Sezzle allows you to buy now and pay later! Shop now, get what you need, and pay later in 4 interest-free installment payments over six weeks.

How To Set Up Buy Now, Pay Later On Your Online ShopBlog Irish Parcels

New Users Only! As low as 0% APR. Free Shipping and Returns on any order. As low as 0% APR. New Customers Can Take an Extra 30% off Hardgoods. As low as 0% APR. Earn OneKeyCash for every dollar spent on eligible hotels, vacation rentals, flights, car rentals & more. With Affirm, you can pay over time at your favorite brands. No late fees or.

Buy Now Pay Later and Other Paytech Innovations Fintech Today

Lowe's Pay is a buy-now-pay-later (BNPL) option that offers customers the ability to pay over time in equal monthly installments. The program offers instant financing for online purchases to be paid by the customer in fixed installments over 3, 6, 12, 18 or 24 months. Lowe's Pay is financed and underwritten by Synchrony Bank.

Buy Now Pay Later App Development in 2022 Quick Guide

How much does Buy Now, Pay Later cost? Zip charges a small convenience fee ranging from $1 to $4 (based on the cost of your item) that is added to each installment. Item Cost. Convenience Fee. Under $200. $1 per installment ($4 over 6 weeks) $200-$400. $2 per installment ($8 over 6 weeks) $401-$600.

Why Do You Need Buy Now Pay Later? Telr

Enjoy now. Pay later. Buy what you love now, and pay later. Break up your payments over weeks or even months. Use PayPal's Buy Now Pay Later App to pay at your favorite retailers. Select a Pay Later offer at checkout, Pay in 4 or Pay Monthly, for qualifying purchases.

Buy now pay later rubber stamp Royalty Free Vector Image

01: SHOP. Shop at your favorite online stores that accept Amazon Pay with Affirm. 02: SELECT AFFIRM AS YOUR PAYMENT METHOD. Check out with Amazon Pay and then select Affirm as your payment method. Enter a few pieces of information for a real-time eligibility decision. 03: CHOOSE YOUR PAYMENT TERMS. You're in control.

What you need to know about buy now, pay later services

Pay your way. Buy now and pay later-choose how much you want to pay and when, every time you shop. Easy checkout. Breeze through checkout at your favorite brands and stores when you pay with Klarna. Hassle-free returns. Not quite right? Report returns with a tap and only pay for what you keep.

Buy Now Pay Later Luxurious Credit

A $6 installment fee is charged at commencement - you pay $1.50 of this fee as a prepaid finance charge when you make your initial payment today. The remaining $4.50 is included in your future payments. Actual installment fees vary and can range from $0 to $7.50 depending on the purchase price and Zip product used.

28 Buy Now, Pay Later Statistics for 2024

Payment schedule: Afterpay offers a pay-in-four payment plan and monthly plans of either six or 12 months. Monthly plans can only be used at select online retailers for purchases of $400 or more.

- Things To Do In Amsterdam Noord

- Magnetic Field Of Helmholtz Coil

- Does Gore Tex Have Pfas

- 3e Vrije Training F1 Jeddah

- Open Of Gesloten Verdeler Vloerverwarming

- Saint Valery Sur Somme Weer

- Verschil Chronische Depressie En Dysthyme Stoornis

- Cast Of The Golden Compass Movie

- Wat Is Een Onroerend Goed

- Waar Zit Vitamine B6 In